Beneath Options

Decoding Positioning Effects for Traders

September 22nd at 1 PM EST

Only 50 spots available

Full Introduction Course

Third Edition

Secure Your Spot Now

289$ FREE

Technicals

Master the essentials of options, the Greeks, and positioning to make precise, strategic trades. Elevate your skills and boost profitability with informed decisions.

Fundamentals

Understand the roles of market makers, delta hedging, and second-order Greeks. Navigate market volatility confidently with solid foundational knowledge.

Our Approach

Predict market moves and stay ahead with our unique methods. Gain actionable strategies to enhance your trading performance and capitalize on opportunities.

“Our journey began with a realization: the market is rife with excessive assumptions made by various tiers in the options trading community.

We observed a gap – a need for a deeper, more insightful approach to understanding options impact on market dynamics.”

– OD

Be The Next One

Understand, then profit

It all starts with proper knowledge…

Topics to be Covered

Technicals

Options

- Fundamentals Overview

Greeks

- Greeks – First Order

- Delta

- Theta

- Vega

- Greeks – Second Order

- Gamma

- Charm

- Vanna

Position vs Open Interest

- Understanding the Difference

Market Makers

Their Roles and Stakes

- How they profit

- Risks involved

Delta

- Second Order Greeks

The SPX Complex

- Its Vastness

0DTE Structural Effect

- Challenges for Dealers

Delta Hedging

What is it?

Why does it matter?

How to do it?

Applicable Uses For Traders

OptionsDepth Approach

Forecasting Dealer’s Flow

1. Learn

Learn the structural impact options have on their underlying asset.

2. Analyze

Signup and obtain access to breakthrough data presented in actionable format.

3. Apply

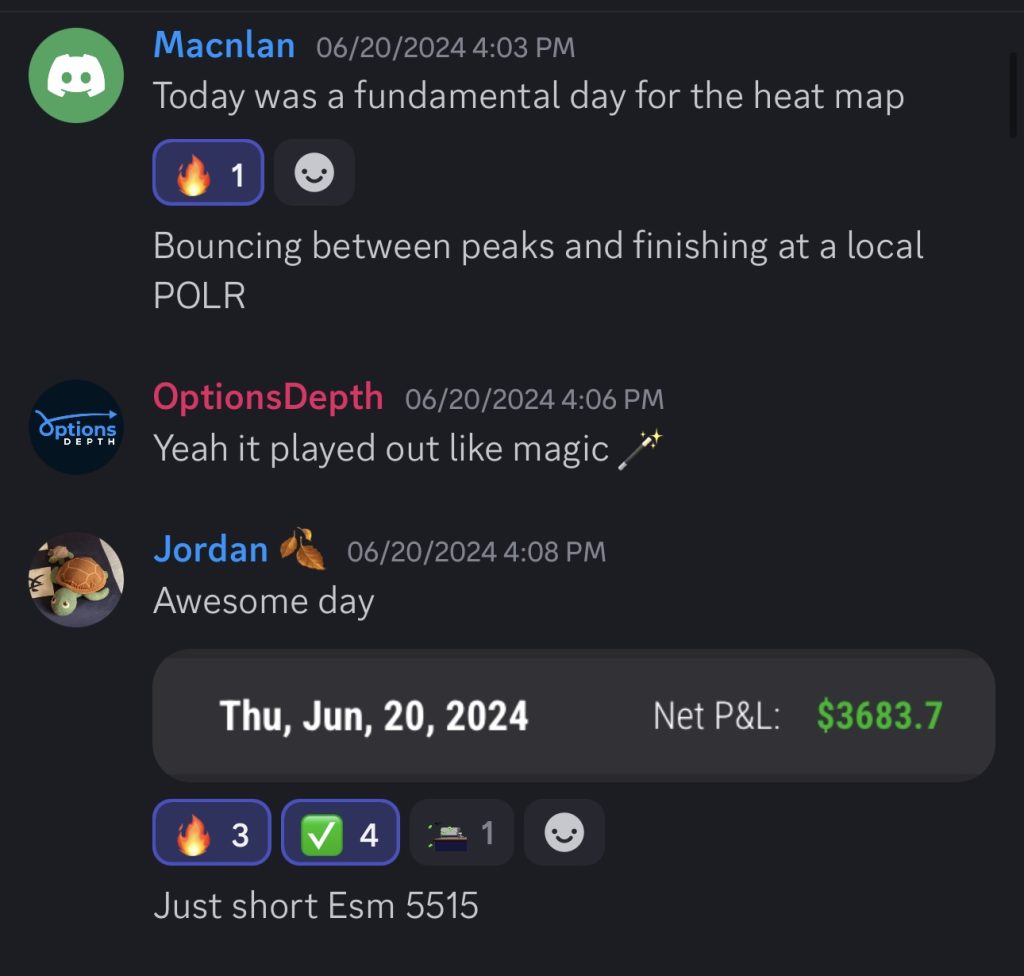

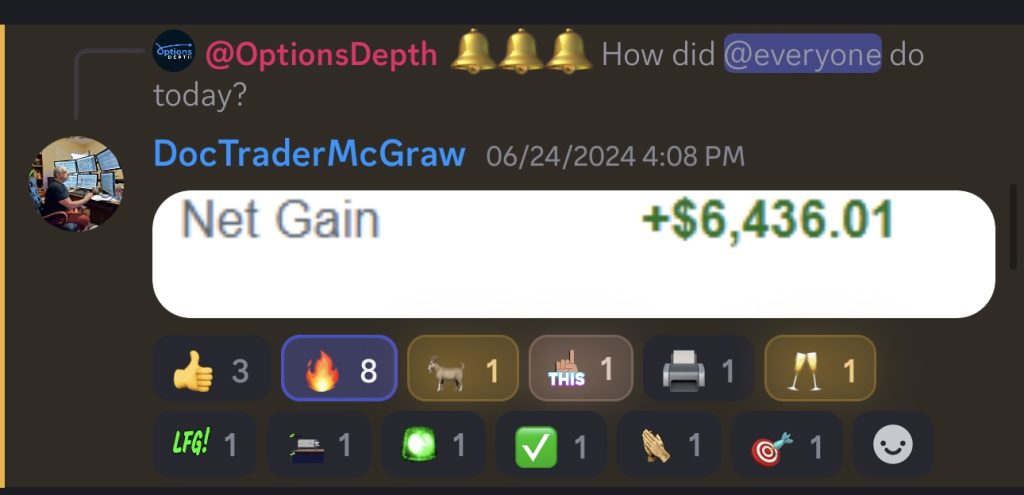

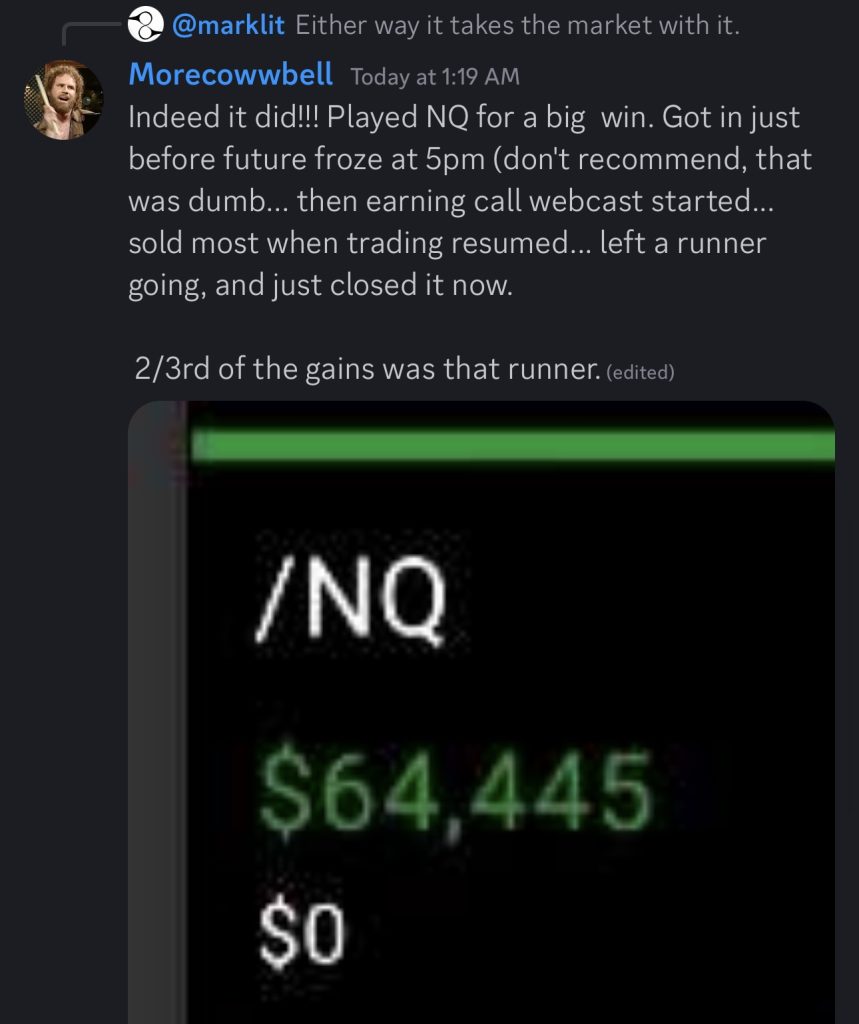

Trade alongside a comunity of profitable traders.

About OptionsDepth

At OptionsDepth, we stand at the forefront of a recent financial phenomenon – the surge in options volume, particularly in the realm of daily 0DTE (zero days to expiration) trading.

Our journey at OptionsDepth began with a crucial insight: the options market is filled with excessive assumptions.

In response, we chose not just to skim the surface but to dive in-depth. We have developed a groundbreaking framework for analyzing options markets.

This framework is our pride – built on the foundation of minimal assumptions and a keen focus on the core message behind options positions.

At OptionsDepth, we believe in clarity and precision.

We offer a clear, insightful perspective – one that empowers traders to understand and navigate the market with confidence.